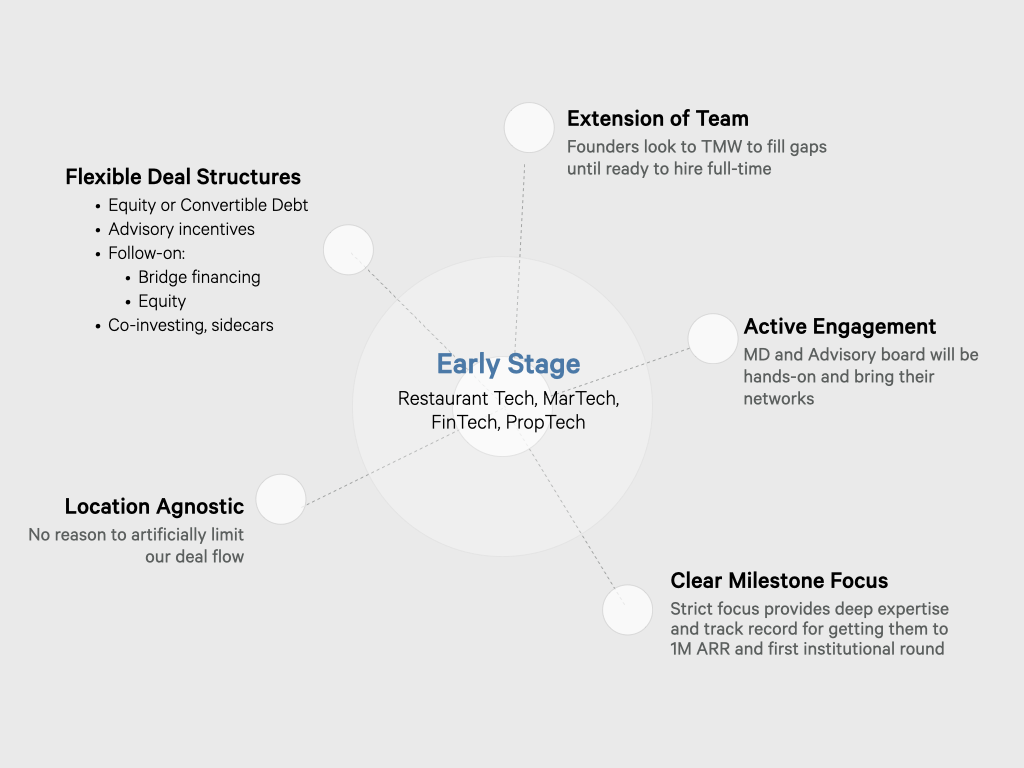

- Restaurant Tech — re-tooling existing restaurants and enabling new models to emerge

- MarTech — exploring new and re-imagining existing communication channels

- PropTech — attacking inefficiencies throughout the entire real estate ecosystem

- FinTech — challenging how/where these services are consumed and utilized

OUR FOCUS

Getting founders to $1MM ARR faster and more efficiently

Founders

Investors

Getting an angel deal done is fun and is a rush, but writing two $25K checks a year is more like gambling than investing.

The VC industry has been around for a long time and their historical returns are pretty clear that 10% of the exits in a tech fund generate 85% of the returns. Protecting your downside requires getting into many deals, so we’ve built a new more efficient angel investing model for HNWs and family offices — fully vetted deals, low or no cost co-investing and sidecars, augmented terms/allocations, etc. With TMW Capital, you can still have the rush of working on early stage deals, but you’ll have the opportunity to see and participate in more quality vetted deals to properly diversify your risk in this asset class.

“Our target batting average is ’1/3, 1/3, 1/3‘ which means that we expect to lose our entire investment on 1/3 of our investments, we expect to get our money back (or maybe make a small return) on 1/3 of our investments, and we expect to generate the bulk of our returns on 1/3 of our investments.”

— Fred Wilson, co-founder of Union Square Ventures, 2009